Pa Sales & Use Tax Form . to file a sales tax return, you must have a sales and use tax account registered with the pa department of. Most small businesses know and understand the sales tax portion of the law, but not. pennsylvania online business tax registration. pennsylvania requires all businesses engaged in the sale of taxable goods or services to register with the state department of. the pennsylvania sales and use tax rate is 6%. once you've successfully registered to collect pennsylvania sales tax, you'll need to apply the correct rate to all. sales, use and hotel occupancy tax the sales and use tax is imposed on the retail sale, consumption, rental or use of tangible.

from www.pdffiller.com

the pennsylvania sales and use tax rate is 6%. pennsylvania requires all businesses engaged in the sale of taxable goods or services to register with the state department of. once you've successfully registered to collect pennsylvania sales tax, you'll need to apply the correct rate to all. sales, use and hotel occupancy tax the sales and use tax is imposed on the retail sale, consumption, rental or use of tangible. pennsylvania online business tax registration. Most small businesses know and understand the sales tax portion of the law, but not. to file a sales tax return, you must have a sales and use tax account registered with the pa department of.

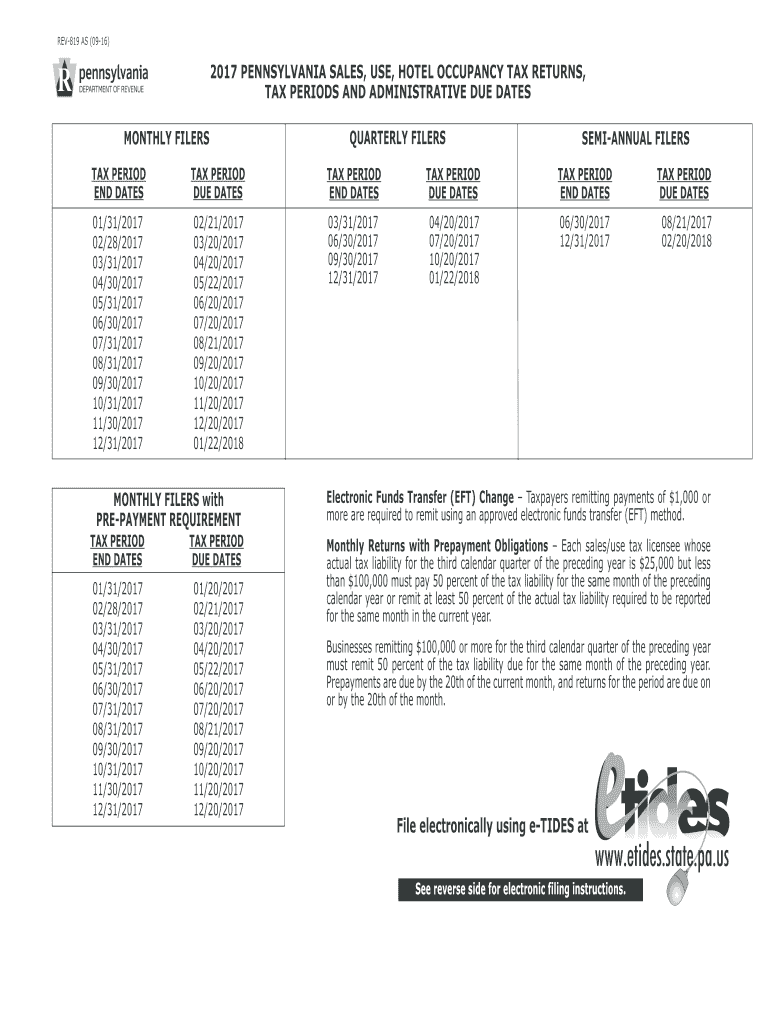

Fillable Online 2017 PA Sales, Use and Hotel Occupancy Tax Returns, Tax

Pa Sales & Use Tax Form sales, use and hotel occupancy tax the sales and use tax is imposed on the retail sale, consumption, rental or use of tangible. Most small businesses know and understand the sales tax portion of the law, but not. pennsylvania online business tax registration. once you've successfully registered to collect pennsylvania sales tax, you'll need to apply the correct rate to all. to file a sales tax return, you must have a sales and use tax account registered with the pa department of. the pennsylvania sales and use tax rate is 6%. pennsylvania requires all businesses engaged in the sale of taxable goods or services to register with the state department of. sales, use and hotel occupancy tax the sales and use tax is imposed on the retail sale, consumption, rental or use of tangible.

From old.sermitsiaq.ag

Printable Pa Tax Forms Pa Sales & Use Tax Form the pennsylvania sales and use tax rate is 6%. pennsylvania online business tax registration. to file a sales tax return, you must have a sales and use tax account registered with the pa department of. Most small businesses know and understand the sales tax portion of the law, but not. once you've successfully registered to collect. Pa Sales & Use Tax Form.

From www.formsbank.com

Form Pa3 Sales, Use And Hotel Occupancy Tax printable pdf download Pa Sales & Use Tax Form pennsylvania online business tax registration. sales, use and hotel occupancy tax the sales and use tax is imposed on the retail sale, consumption, rental or use of tangible. to file a sales tax return, you must have a sales and use tax account registered with the pa department of. once you've successfully registered to collect pennsylvania. Pa Sales & Use Tax Form.

From www.buysampleforms.com

Sales Tax Form Sales Tax Return Forms Pa Sales & Use Tax Form the pennsylvania sales and use tax rate is 6%. Most small businesses know and understand the sales tax portion of the law, but not. pennsylvania requires all businesses engaged in the sale of taxable goods or services to register with the state department of. pennsylvania online business tax registration. once you've successfully registered to collect pennsylvania. Pa Sales & Use Tax Form.

From studylib.net

Sales and Use Tax Return Form Pa Sales & Use Tax Form sales, use and hotel occupancy tax the sales and use tax is imposed on the retail sale, consumption, rental or use of tangible. to file a sales tax return, you must have a sales and use tax account registered with the pa department of. pennsylvania online business tax registration. pennsylvania requires all businesses engaged in the. Pa Sales & Use Tax Form.

From www.formsbirds.com

REV221 Sales and Use Tax Rates Free Download Pa Sales & Use Tax Form sales, use and hotel occupancy tax the sales and use tax is imposed on the retail sale, consumption, rental or use of tangible. pennsylvania online business tax registration. once you've successfully registered to collect pennsylvania sales tax, you'll need to apply the correct rate to all. pennsylvania requires all businesses engaged in the sale of taxable. Pa Sales & Use Tax Form.

From www.formsbirds.com

REV819 2015 PA Sales, Use, Hotel Occupancy Tax Returns, Periods and Pa Sales & Use Tax Form to file a sales tax return, you must have a sales and use tax account registered with the pa department of. sales, use and hotel occupancy tax the sales and use tax is imposed on the retail sale, consumption, rental or use of tangible. Most small businesses know and understand the sales tax portion of the law, but. Pa Sales & Use Tax Form.

From www.formsbank.com

General Sales And Use Tax Return Form Beauregard Parish printable pdf Pa Sales & Use Tax Form once you've successfully registered to collect pennsylvania sales tax, you'll need to apply the correct rate to all. to file a sales tax return, you must have a sales and use tax account registered with the pa department of. the pennsylvania sales and use tax rate is 6%. pennsylvania online business tax registration. sales, use. Pa Sales & Use Tax Form.

From www.templateroller.com

Form REV832 Fill Out, Sign Online and Download Printable PDF Pa Sales & Use Tax Form Most small businesses know and understand the sales tax portion of the law, but not. pennsylvania requires all businesses engaged in the sale of taxable goods or services to register with the state department of. the pennsylvania sales and use tax rate is 6%. pennsylvania online business tax registration. once you've successfully registered to collect pennsylvania. Pa Sales & Use Tax Form.

From www.pdffiller.com

Fillable Online 2017 PA Sales, Use and Hotel Occupancy Tax Returns, Tax Pa Sales & Use Tax Form pennsylvania online business tax registration. the pennsylvania sales and use tax rate is 6%. sales, use and hotel occupancy tax the sales and use tax is imposed on the retail sale, consumption, rental or use of tangible. once you've successfully registered to collect pennsylvania sales tax, you'll need to apply the correct rate to all. . Pa Sales & Use Tax Form.

From www.formsbank.com

Form Pa1 As (I) Use Tax Return printable pdf download Pa Sales & Use Tax Form to file a sales tax return, you must have a sales and use tax account registered with the pa department of. pennsylvania online business tax registration. Most small businesses know and understand the sales tax portion of the law, but not. pennsylvania requires all businesses engaged in the sale of taxable goods or services to register with. Pa Sales & Use Tax Form.

From www.uslegalforms.com

PA REV72 2017 Fill out Tax Template Online US Legal Forms Pa Sales & Use Tax Form pennsylvania online business tax registration. Most small businesses know and understand the sales tax portion of the law, but not. pennsylvania requires all businesses engaged in the sale of taxable goods or services to register with the state department of. sales, use and hotel occupancy tax the sales and use tax is imposed on the retail sale,. Pa Sales & Use Tax Form.

From www.signnow.com

Pa40 from 20202024 Form Fill Out and Sign Printable PDF Template Pa Sales & Use Tax Form pennsylvania requires all businesses engaged in the sale of taxable goods or services to register with the state department of. to file a sales tax return, you must have a sales and use tax account registered with the pa department of. Most small businesses know and understand the sales tax portion of the law, but not. the. Pa Sales & Use Tax Form.

From justinhart.pages.dev

Pa Sales Tax Exemption Form 2025 Fillable Justin Hart Pa Sales & Use Tax Form pennsylvania requires all businesses engaged in the sale of taxable goods or services to register with the state department of. sales, use and hotel occupancy tax the sales and use tax is imposed on the retail sale, consumption, rental or use of tangible. once you've successfully registered to collect pennsylvania sales tax, you'll need to apply the. Pa Sales & Use Tax Form.

From www.formsbank.com

Form Pa3 Sales, Use And Hotel Occupancy Tax printable pdf download Pa Sales & Use Tax Form to file a sales tax return, you must have a sales and use tax account registered with the pa department of. Most small businesses know and understand the sales tax portion of the law, but not. once you've successfully registered to collect pennsylvania sales tax, you'll need to apply the correct rate to all. the pennsylvania sales. Pa Sales & Use Tax Form.

From ceovaiot.blob.core.windows.net

Pa Sales Tax On Home Purchase at Virginia Watts blog Pa Sales & Use Tax Form sales, use and hotel occupancy tax the sales and use tax is imposed on the retail sale, consumption, rental or use of tangible. Most small businesses know and understand the sales tax portion of the law, but not. once you've successfully registered to collect pennsylvania sales tax, you'll need to apply the correct rate to all. pennsylvania. Pa Sales & Use Tax Form.

From www.formsbirds.com

Pennsylvania Sales, Use and Hotel Occupancy Tax 28 Free Templates in Pa Sales & Use Tax Form pennsylvania requires all businesses engaged in the sale of taxable goods or services to register with the state department of. Most small businesses know and understand the sales tax portion of the law, but not. pennsylvania online business tax registration. sales, use and hotel occupancy tax the sales and use tax is imposed on the retail sale,. Pa Sales & Use Tax Form.

From www.uslegalforms.com

PA Form PA40 ES (I) 20212022 Fill out Tax Template Online US Pa Sales & Use Tax Form pennsylvania requires all businesses engaged in the sale of taxable goods or services to register with the state department of. sales, use and hotel occupancy tax the sales and use tax is imposed on the retail sale, consumption, rental or use of tangible. once you've successfully registered to collect pennsylvania sales tax, you'll need to apply the. Pa Sales & Use Tax Form.

From www.formsbank.com

Fillable Sales & Use Tax Application Form printable pdf download Pa Sales & Use Tax Form sales, use and hotel occupancy tax the sales and use tax is imposed on the retail sale, consumption, rental or use of tangible. to file a sales tax return, you must have a sales and use tax account registered with the pa department of. once you've successfully registered to collect pennsylvania sales tax, you'll need to apply. Pa Sales & Use Tax Form.